It’s well known that New York is the second-strongest state economy in the U.S. and the fourth-largest by population. But surprisingly, its cannabis sales only rank fifth nationwide—behind states like Massachusetts. This gap shows just how much growth potential New York’s cannabis market still has. So let’s take a closer look at what’s happening in the state right now.

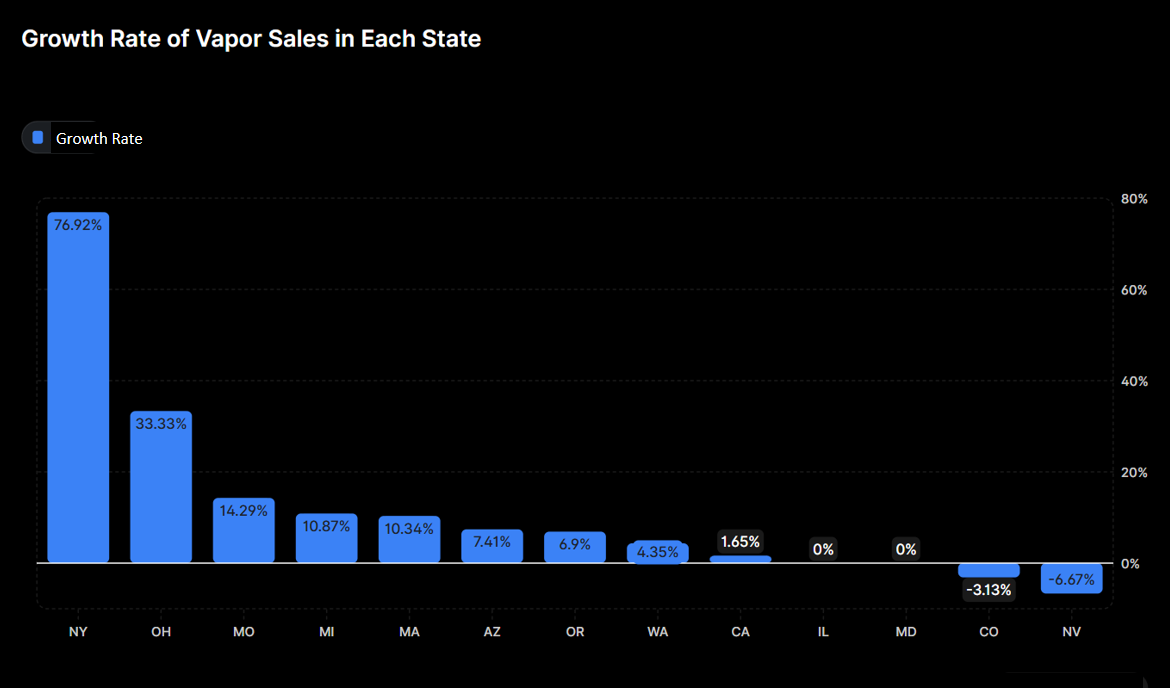

In 2025, New York’s cannabis market absolutely took off. Sales jumped more than 70% year-over-year, making it the fastest-growing recreational cannabis state in the country.

On top of that, New York currently has the highest cannabis product prices in the U.S.

So why is this happening? Let’s break it down.

New York State Cannabis License OverviewNew York State Cannabis License Overview

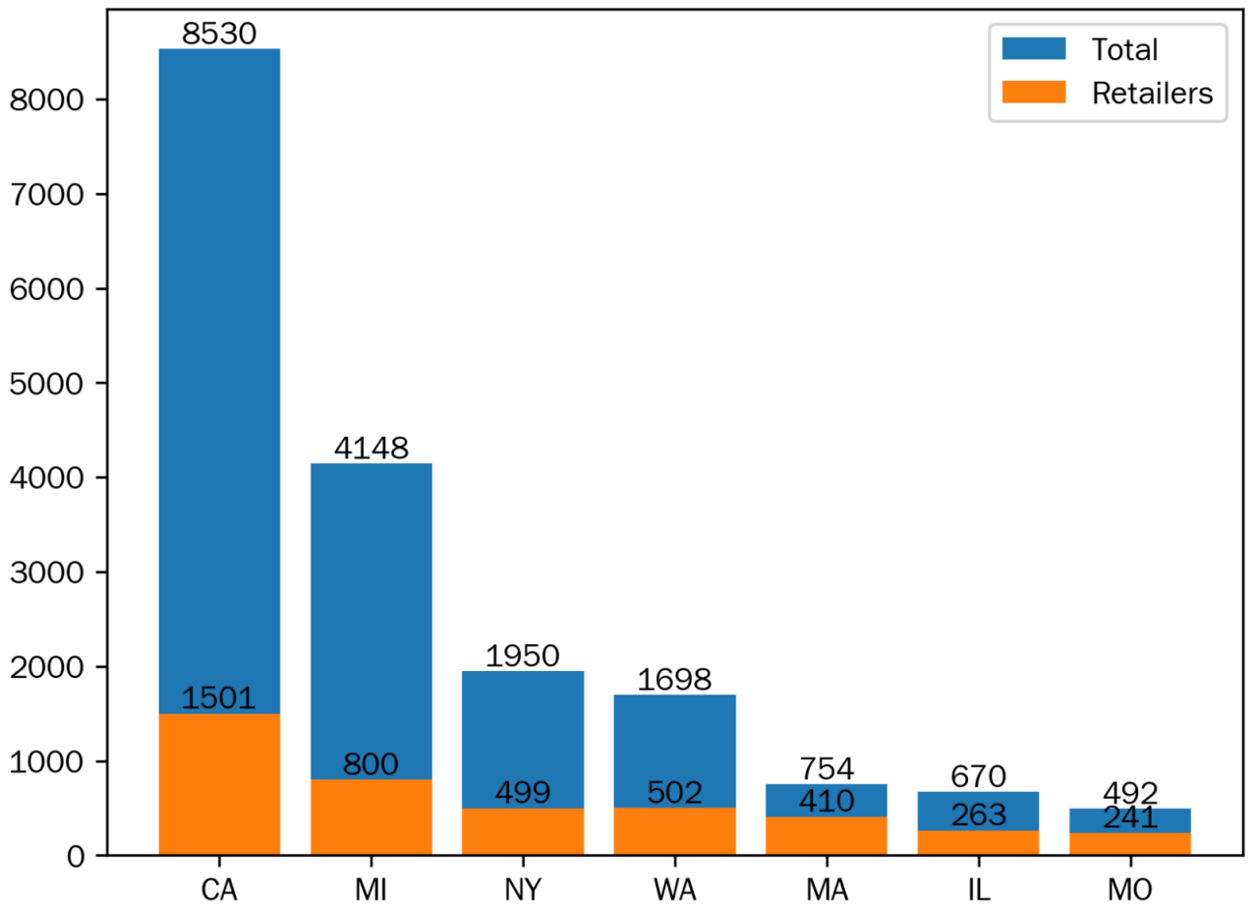

As of now, New York has issued around 1,950 total cannabis licenses, including roughly 1,074 retail licenses. About 500 stores have actually opened, while the rest are still preparing to launch. For comparison, California has around 8,530 operating licenses, and Michigan has about 4,148.

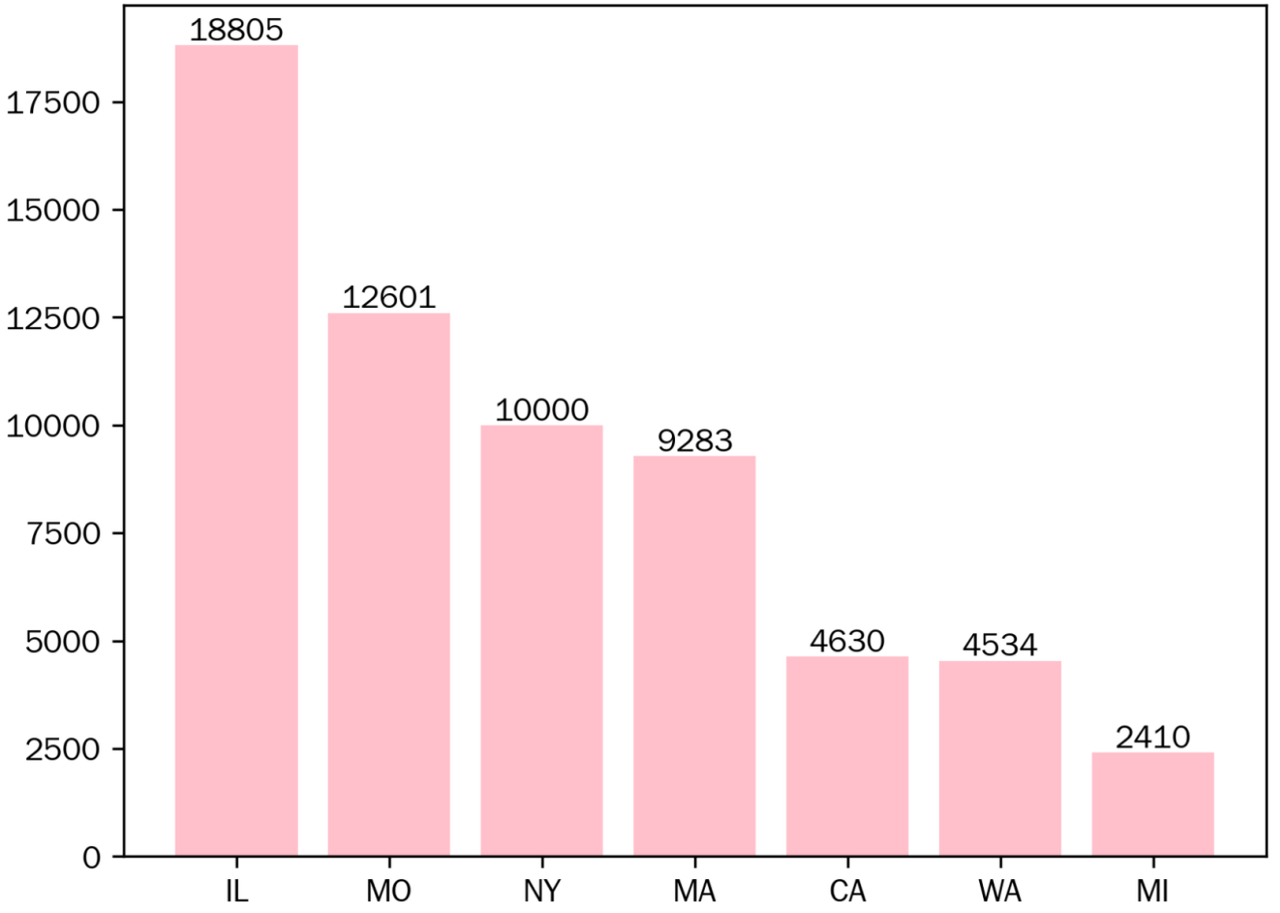

If we look at population per license—basically how many residents each license serves—we get a sense of license value:

- Illinois: 18,805 people per license (highest value)

- New York: 10,000

- California: 4,630

- Michigan: 2,410

This shows New York licenses are still extremely valuable. Slow license rollout has kept supply tight, and because New York only started adult-use sales in December 2022, the market is still young. These factors all contribute to higher product prices.

However, as more businesses open and the market matures, prices in New York are expected to continue dropping.

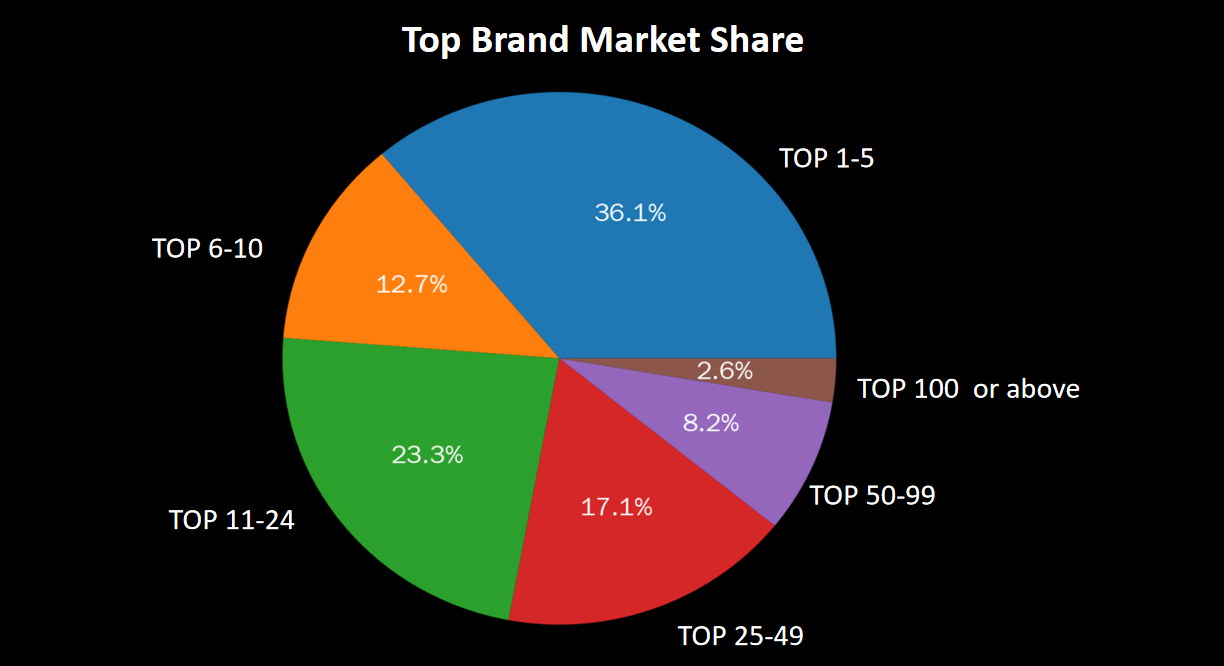

Market Share Breakdown

Across all cannabis categories:

- The top 10 brands hold 48.8% of the market

- The top 25 brands hold 72.1% of the market

Based on trends in other states, New York’s top 10 brands will likely take an even larger share over time.

New York’s Vape Market

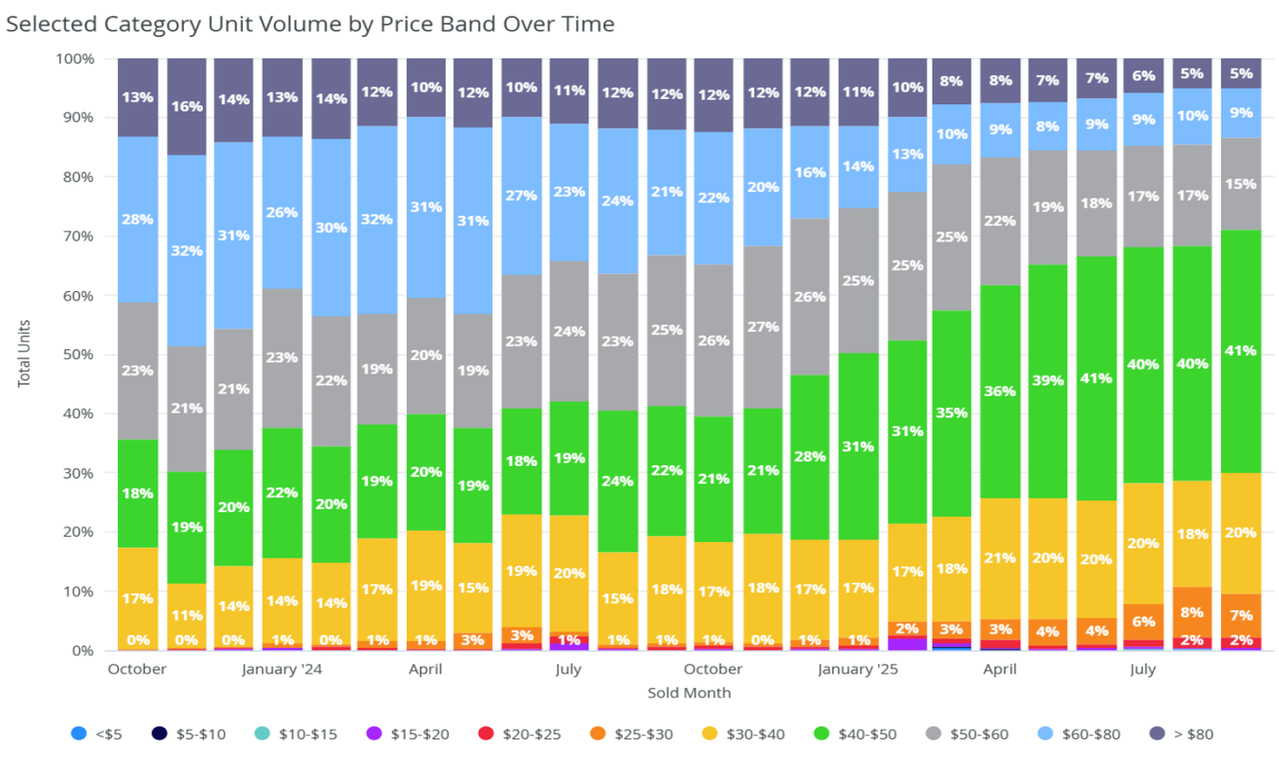

Over the past two years, vape prices in New York have steadily declined—right in line with the overall cannabis market trend.

- Back in 2023, 51% of vape products were priced between $50 and $80.

- Today, the market looks very different — 61% of vapes now fall in the $30 to $50 range.

In terms of product formats:

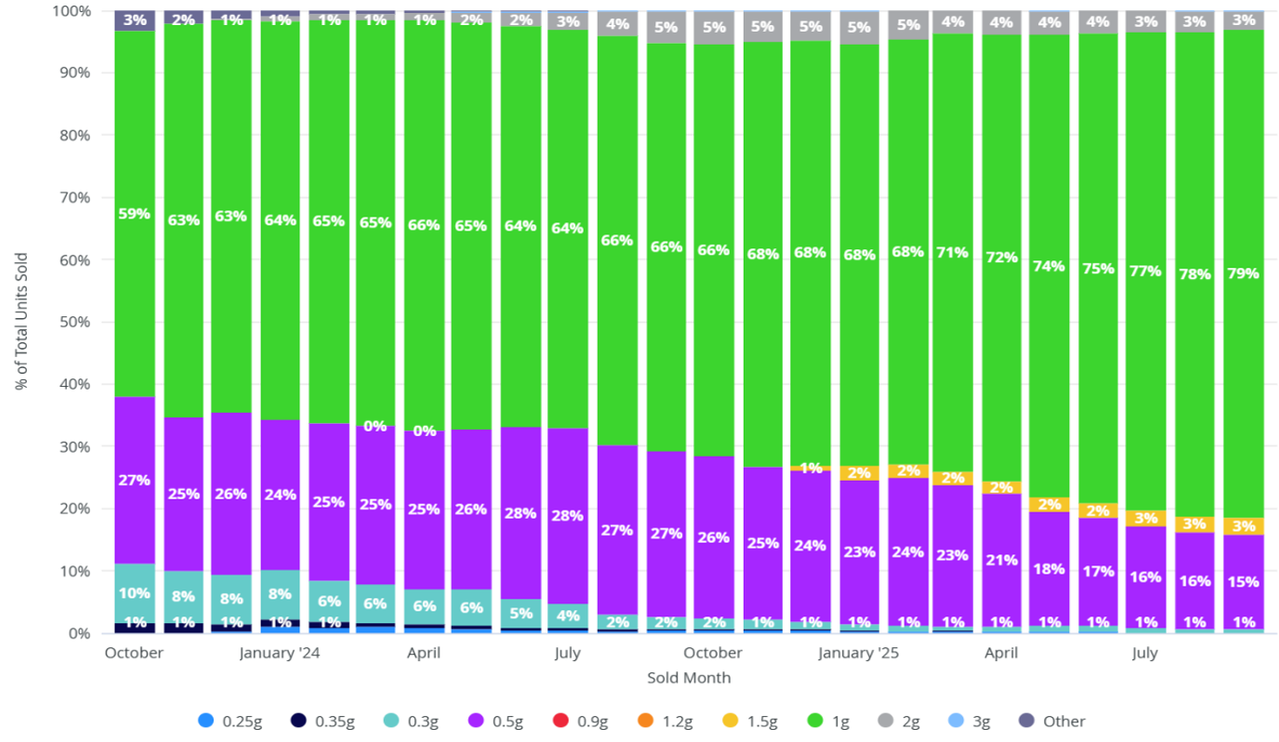

- 1.0g vapes dominate the market, and their share keeps growing

- 0.5g and 0.3g formats are shrinking, with 0.3g nearly gone from shelves

- Starting in 2025, 1.5g products emerged and began gaining traction; combined with 2.0g vapes, they now make up about 6% of total vape sales

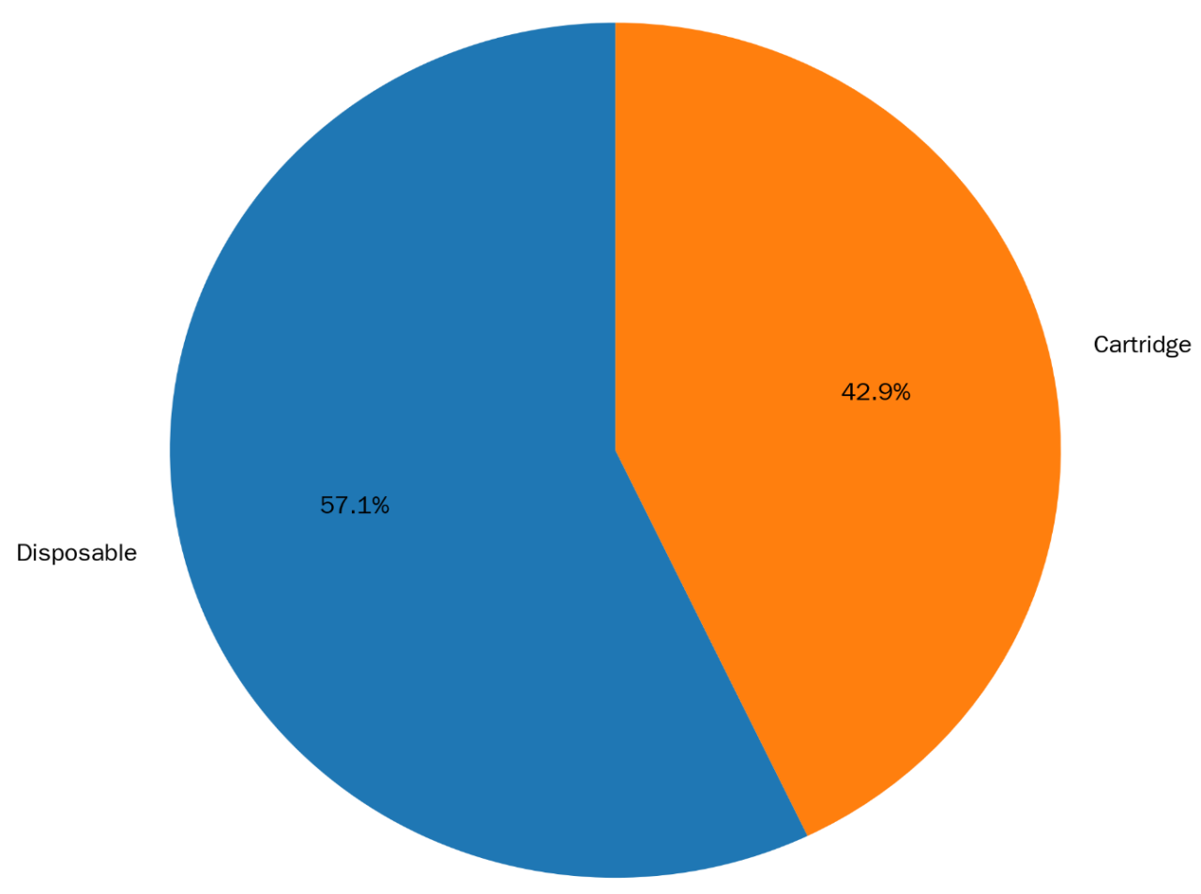

For device type:

- Disposable vapes lead with 57.1% of the market

- 510 cartridges account for 42.9%

Most consumers still prefer the convenience of disposables.

We’ll continue sharing more industry insights and market data.

If you’re into this type of content, make sure to follow our LINKEDIN page!